Glory be, it's Tax Time in Australia once again! The end of financial year has clocked over (10 days ago at the time of writing) and it's now that time to go through your receipts, log books and purchases over the last 12 months to work out what you can claim.

And if you're like me and got into the world of cryptocurrency in 2017-18, then it's time to calculate any capital gains and losses for the term.

Considering how many tiny tiny trades I have made up until now (and only since November when I kicked off my portfolio with just $10 of Bytecoin..) - I was looking at a tonne of entries to painfully work out.

298 all up. That's a tonne of data entry if you're trying to plot where your money went and how much it gained and lost along the way.

Thankfully I figured a much easier way to work it all out using your exchange, excel, a website and a couple of hours...

So even if you trade one crypto for another, it still counts a capital gains event.

"Don't forget that both selling and trading crypto currencies are taxable events. Spending crypto currencies under certain conditions may be taxable as well, so don't get caught out!"

Which means even with tiny transactions of say SC to BCN that netted a positive gain of just 8 cents since you bought the SC, that still counts. Those 8 cents are now counted as a capital gain.

So not counting the 'I bought INSERT CRYPTO HERE with AUD' transactions, this still meant that any time I traded Crypto with Crypto, I'd need to work out the gain or loss. I had a handful of big gains and a busload of minor and a few losses on the way. They all needed to be added up to report this year.

However if you're like me and like putting the legwork in yourself, here's how I did it

(and it didn't cost me anything either other than time, how good is that?)

For this example I'm using Coinspot (the exchange I use) so your starting point might be a little different but it's all headed to the same end so most of the steps should be the same.

1. DOWNLOAD A STATEMENT OF ALL YOUR TRANSACTIONS IN CSV FORMAT

In Coinspot you'll find this option under Account / Order History

Rate Inc. fee

Rate ex. fee

Fee

Fee (AUD)

(GST AUD)

We still need type for now but will be deleting it later.

Highlight each column you don't need, delete and it and shift cells left. You should have just the bare bones left:

At it's most basic level you now have 1) when you bought it/traded it 2) What you bought it with 3) how much it cost 4) What you ended up with.

I ended up doing this on two seperate pages to avoid any confusion. One for the buy orders and one for the sell orders. You can always put these back together when you're done.

They're all coins bought with AUD, so the AUD part needs to go (it's going to turn up in our second currency column). We could manually delete each one but far quicker would be to highlight just that column and do a find and replace, replacing the /*** with nothing.

(Then I'd go through and do find and replace with /BCN /IOT /ETH etc - all the coins I've ever traded. This cuts down time editing considerably.)

On our sent column on the BUY page

Our 'sent quantity' needs to only have numbers in it and the 2nd currency column can only have the currency symbol. So take the currency out of one and move to the other. (I typed in a few currencies and then copy pasted large sections to save time. Then I highlighted just the 'sent quantity' column and did the find and replace trick similar to above. Finding and replacing crypto symbols with nothing.

At the end, we have the following:

For the SELL page

Basic but that's all we need here.

Now that we have both pages looking like this, we can combined the data on one page, then sort by date so we can make some sense of the timeline and save it as a CSV.

Yep, CSV. It won't work otherwise.

6. Point your browser to Cointracker.io

Once we upload our CSV file, it's going to crunch the numbers. So we'll head to the import transactions part:

Give your wallet a name.

Then hit Import Transactions and watch it find the most minor of incorrect details. Mine failed to load for the first few times for a number of reasons:

-The headers were incorrect (they have to be spelt just the way it wants or it won't recognise anything.)

-It didn't recognise MIOTA (changed to IOT)

-It didn't recognise STR (changed to XLM)

-It didn't recognise BCC (changed to BCH)

-It didn't recognise the file type (it was saved as .xlsx so resaved as .csv)

Once it finally ran out of things to find fault with, it finally coughed up twenty pages of info and asked me to review them. Happy there are two things that stick out quite well on each page:

CRYPTO TRADES YOU MADE A GAIN ON

CRYPTO TRADES YOU TOOK A HIT ON

Now it's a simple process of adding up all the gains and add up all the losses and then take the losses from the gains tally to see how you fared.

Ie: You made $356 worth of gains but $78 of reported losses, then your capital gains for that financial year would be 356-78= $278.

Note: Don't forget any discounts your entitled to if you've held your coins for longer than one year. For all my transactions, they are less than 12 months old so no discount. When in doubt, chat to the tax people.

PHEW! Got there in the end. Of course it'd be much easier if you paid someone to do this of course but that'd be less money to spend on your precious altcoins :)

Let me know if you found this helpful and if you did, please share it to help someone else get slightly less confused about their capital gains this financial year.

Any questions/corrections/glaringly obvious mistakes I've made - please let me know below. Good luck cryptocommunity!

And if you're like me and got into the world of cryptocurrency in 2017-18, then it's time to calculate any capital gains and losses for the term.

Considering how many tiny tiny trades I have made up until now (and only since November when I kicked off my portfolio with just $10 of Bytecoin..) - I was looking at a tonne of entries to painfully work out.

298 all up. That's a tonne of data entry if you're trying to plot where your money went and how much it gained and lost along the way.

Thankfully I figured a much easier way to work it all out using your exchange, excel, a website and a couple of hours...

Important note before you get started.

Read this entire post start to finish before you even get started. Read it again to make things a little bit clearer the second time around. It does look a little complex but it's actually more time consuming than anything. Take each step carefully and it doesn't hurt to double check things along the way.

Also I am not a tax expert in the slightest, just a guy with a lot of minor trades to figure my cap gains on..

Some reading helped a lot before I worked out what info I needed

This comprehensive thread on Reddit: BitcoinAus Tax Megathread 2 is a fantastic place to start, ask and puzzling questions and check out all the answers.

What I have learnt in the last couple of days after reading RE: Australian Capital Gains Tax in Australia

While originally I thought I'd be taxed on only the cryto I traded back to fiat (in this case AUD) it turns out that the ATO classes a cryptocurrency as an asset.So even if you trade one crypto for another, it still counts a capital gains event.

"Don't forget that both selling and trading crypto currencies are taxable events. Spending crypto currencies under certain conditions may be taxable as well, so don't get caught out!"

Which means even with tiny transactions of say SC to BCN that netted a positive gain of just 8 cents since you bought the SC, that still counts. Those 8 cents are now counted as a capital gain.

So not counting the 'I bought INSERT CRYPTO HERE with AUD' transactions, this still meant that any time I traded Crypto with Crypto, I'd need to work out the gain or loss. I had a handful of big gains and a busload of minor and a few losses on the way. They all needed to be added up to report this year.

You can get someone to do it for you (work out your Cryto tax etc)

In the Reddit thread linked above, there's a couple of places mentioned that offer services to do it for you. Having no experience of any of them, I can't vouch for their services. However if you have thousands of transactions and no idea where to start you probably should considering enrolling a professional.However if you're like me and like putting the legwork in yourself, here's how I did it

(and it didn't cost me anything either other than time, how good is that?)

Al's guide to calculating your Cryptocurrency Capital Gains (or losses) in Australia.

There's a few steps involved and a bit of stuffing around to get things exactly correct for this but when you end up with a handy guide of every gain and loss you made along the way, it's a big help in calculating that missing number in your capital gains section.For this example I'm using Coinspot (the exchange I use) so your starting point might be a little different but it's all headed to the same end so most of the steps should be the same.

1. DOWNLOAD A STATEMENT OF ALL YOUR TRANSACTIONS IN CSV FORMAT

In Coinspot you'll find this option under Account / Order History

2. OPEN IT UP IN EXCEL AND GET RID OF ALL OF THE COLUMNS YOU WON'T NEED.

In our Coinspot example here we won't need the following columns:Rate Inc. fee

Rate ex. fee

Fee

Fee (AUD)

(GST AUD)

We still need type for now but will be deleting it later.

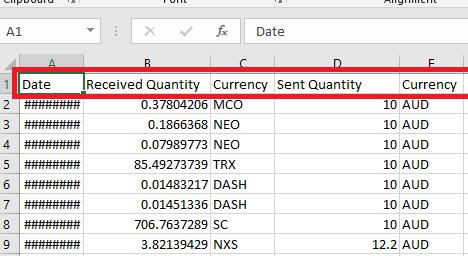

Highlight each column you don't need, delete and it and shift cells left. You should have just the bare bones left:

At it's most basic level you now have 1) when you bought it/traded it 2) What you bought it with 3) how much it cost 4) What you ended up with.

3. Now sort it by buy or sell (highlight all except the 1 columns, right click, choose sort, custom sort, sort by 'type')

We're going to sort it into two piles now, a buy and a sell. If you plug this into the website we are going to use now as it is, half the numbers are going to come out in the incorrect places (Ie you sold 5000 BCN to gain 2.5 SC when it's actually the other way around.)I ended up doing this on two seperate pages to avoid any confusion. One for the buy orders and one for the sell orders. You can always put these back together when you're done.

4. On both pages, we're now going to move some columns around.

On the buy sheet:

The amount column will now go before the market column. I just cut and paste things to move them around.

On the sell sheet:

The 'total inc GST' column will now go before the market column. This is what threw me the first few times. With coinspot the buys and sells are listed differently. By setting it up this way, every transaction now runs the same way

WHEN - HOW MANY NEW COIN DID YOU GET - WHAT COIN - HOW MUCH OLD COIN DID IT COST - WHAT WAS THE OLD COIN

On both sheets:

An extra column will be built at the end. This will be our new 2nd Currency Column.

Now to change the column names:

(They have to be this exact way otherwise when we put it into the sorter, it'll just spit it out as an error. Pedantic I know..)

Once you've done the moving, you can name everything to the below accordingly and it should look roughly like this:

(This is an example of what our finished page will look like. We're a few steps away this. So far your second currency column will be empty because the currency is actually still part of the Sent Quality column. We will fix this in a sec)

You'll notice the type section is no longer there? You can get rid of it now having worked out which is your buys and which are your sells.

5. Let's strip away even more redundant info.

Highlight the date column, right click, choose format cells, click custom, scroll down to the option of d/mm/yyyy h:mm and in the general section above, change it to following:

This sorts our time section into a format that our reporting service can understand.

In the column formerlly known as 'Market', now called our first Currency column you'll see you've got both markets involved in the trade. You're only going to need one.

This will be the coin or currency you received at the end of the trade.

ie I traded BTC for BCN. In the first Currency coliumn I will mark that it's BCN. I will use BTC in the second Currency column as that's what I used to buy the BCN.

So in these cases on our buy page:

| LBC/AUD |

| WPR/AUD |

| SRN/AUD |

| DENT/AUD |

| NXS/AUD |

| RHOC/AUD |

(Then I'd go through and do find and replace with /BCN /IOT /ETH etc - all the coins I've ever traded. This cuts down time editing considerably.)

On our sent column on the BUY page

Our 'sent quantity' needs to only have numbers in it and the 2nd currency column can only have the currency symbol. So take the currency out of one and move to the other. (I typed in a few currencies and then copy pasted large sections to save time. Then I highlighted just the 'sent quantity' column and did the find and replace trick similar to above. Finding and replacing crypto symbols with nothing.

At the end, we have the following:

|

| Only a number in the Sent column and a coin in the Currency column. |

For the SELL page

Obviously because you moved a different column around compared to the BUY page, things will look a little different.

The process is the same, strip away the information until you end up with the same bare bones parts which is:

WHEN - HOW MANY NEW COIN DID YOU GET - WHAT COIN - HOW MUCH OLD COIN DID IT COST - WHAT WAS THE OLD COIN

Which once you tidy things up, will look like this:

Now that we have both pages looking like this, we can combined the data on one page, then sort by date so we can make some sense of the timeline and save it as a CSV.

Yep, CSV. It won't work otherwise.

6. Point your browser to Cointracker.io

Once we upload our CSV file, it's going to crunch the numbers. So we'll head to the import transactions part:

Give your wallet a name.

Then hit Import Transactions and watch it find the most minor of incorrect details. Mine failed to load for the first few times for a number of reasons:

-The headers were incorrect (they have to be spelt just the way it wants or it won't recognise anything.)

-It didn't recognise MIOTA (changed to IOT)

-It didn't recognise STR (changed to XLM)

-It didn't recognise BCC (changed to BCH)

-It didn't recognise the file type (it was saved as .xlsx so resaved as .csv)

Once it finally ran out of things to find fault with, it finally coughed up twenty pages of info and asked me to review them. Happy there are two things that stick out quite well on each page:

CRYPTO TRADES YOU MADE A GAIN ON

CRYPTO TRADES YOU TOOK A HIT ON

Now it's a simple process of adding up all the gains and add up all the losses and then take the losses from the gains tally to see how you fared.

Ie: You made $356 worth of gains but $78 of reported losses, then your capital gains for that financial year would be 356-78= $278.

Note: Don't forget any discounts your entitled to if you've held your coins for longer than one year. For all my transactions, they are less than 12 months old so no discount. When in doubt, chat to the tax people.

PHEW! Got there in the end. Of course it'd be much easier if you paid someone to do this of course but that'd be less money to spend on your precious altcoins :)

Let me know if you found this helpful and if you did, please share it to help someone else get slightly less confused about their capital gains this financial year.

Any questions/corrections/glaringly obvious mistakes I've made - please let me know below. Good luck cryptocommunity!

2021 UPDATE CRYOTAX, I MEAN CRYPTO TAX

I haven't used a tax agent in years but for this years tax return I did and wasn't ready for the question 'Tell me of your cryptocurrency.' While I had a general profit/loss from working things out earlier (thanks to Cointracker.io) I came unstuck when he asked how much Crypto I'd bought in the space of the financial year. I had a quick guess and then double checked anyway to find out I was horribly wrong and had bought a lot more than I originally thought.

If you're getting a tax expert to go over things like this, make sure you have as much information on hand as possible - buys, sells, trades, bonuses, everything and save yourself some hassle in the long run.

Comments

Post a Comment